It’s Past Time to Fix Healthcare for the Elderly

As we get older, we become more dependent on an undependable healthcare industry. Today’s public-private arrangement isn’t getting the job done.

Hi, everyone! We really need to talk about how bad healthcare is for elderly people. As more of us get older, the healthcare system is falling short in meeting the unique needs of seniors. And the situation is destined to become worse since the current 60 million people enrolled in Medicare will grow to 65 million by 2035.

Despite the Trump administration’s intention and actions to cut funding for Medicare and Medicaid, expansion of these two programs must be on the agenda. Kamala Harris, as the Democratic candidate for President, proposed some modest expansion of support for home care services along with hearing and vision coverage. Other proposals along these lines have also been proposed. Let’s dig in a little.

Expand Medicare to Include Long-Term Care

Personal Note: I’m much older than my wife. If I were to need assisted living services, she and I would find it impossible to live together in a retirement home. She would also be unable to care for me directly since her employment is our major source of income. We have concluded, therefore, that we need to maintain our independence as a couple for as long as possible. If long-term care services, especially in-home, remain unavailable when my (now very good) health declines, we will face a dreadful situation. This issue is personal.

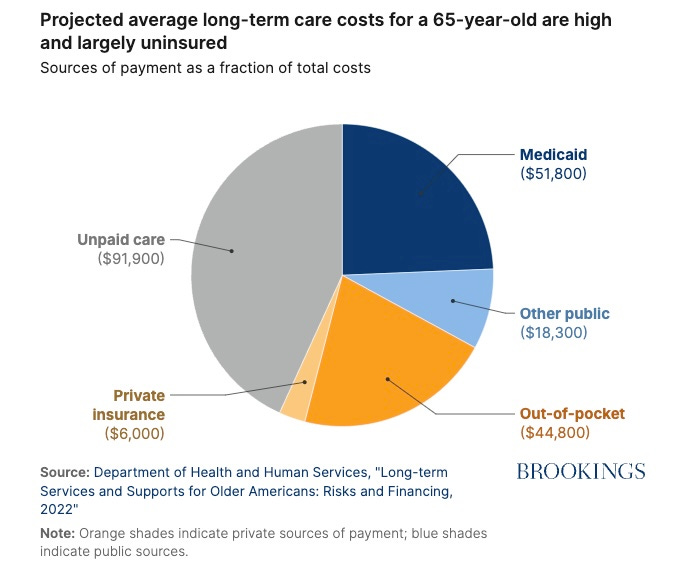

While Medicare covers temporary skilled care services for its members, there is a huge gap between the resources that many people have and what long-term care in a nursing home or skilled care facility will cost. While it is true that Medicaid covers long-term care for many seniors, the limitation on total financial resources is so strict – less than $2,901 income per month, and up to $2,000 in “countable assets” – that most individuals 65 and older cannot qualify.[1]

The Brookings Institution has provided a helpful chart of projected lifetime, long-term care costs for an individual.[2]

There are several advantages to expanding Medicare to cover in-home, long-term care.

Seniors will have more and better access to long-term care.

Families will receive financial and, often, personal relief as caregivers for elderly family members.

Hospital admissions and premature nursing home admissions will be reduced, thereby reducing overall healthcare costs. (Such reductions in costs are often overlooked by those who oppose this expansion.)

Chronic conditions, especially those requiring special needs plans (C-SNPs) will be addressed more effectively by providing support for daily activities.

Now unpaid caregivers (often family members) can return to the workforce.

Seniors will enjoy greater quality of life, personal dignity, and equality of access to needed healthcare services.

Medicare Should Include Hearing, Vision, and Dental Coverage

Personal Note: Within the past six years and despite my membership in Medicare Advantage through my previous employer, I did not obtain needed dental services because of cost. This caused additional dental problems, including the loss of a tooth. I also delayed obtaining hearing aids for several years despite audiology tests that showed my needing them. When I was finally able to pay out of pocket, I purchased hearing aids online for approximately $2,000. I always paid out of pocket for eyeglasses because vision is essential to my work. Again, this is personal.

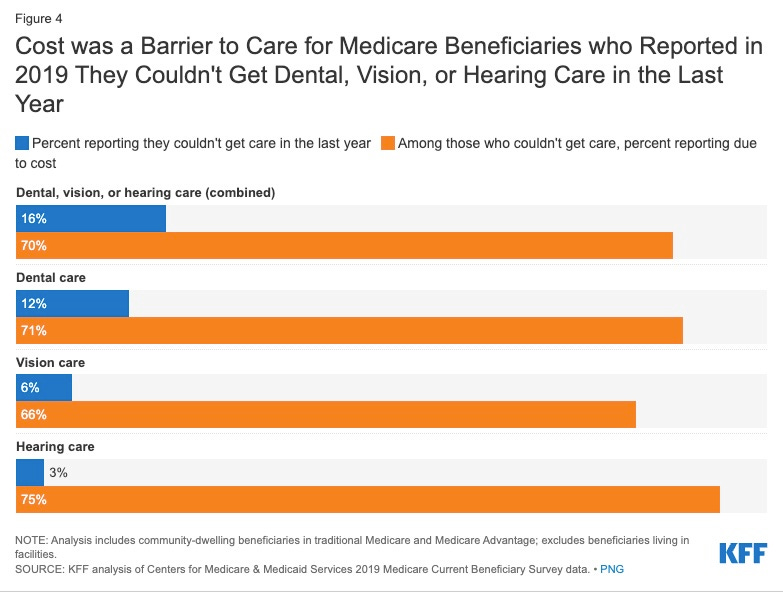

Original Medicare does not provide coverage for hearing, vision, or dental services unless very limited, special medical conditions are met. And yet, nearly all senior citizens need hearing assistance, eyeglasses or other aids, and dental care. I can think of no exceptions.

Some employers’ insurance plans offer limited coverage, but that typically ends when an employee leaves the organization or retires. Private insurance that includes such coverage is prohibitively expensive for most.

Most Medicare Advantage (MA) plans (private carriers who administer Medicare in exchange for a fixed payment by Medicare to them) offer some hearing, vision, and dental coverage. This is major reason that many seniors elect to enroll in these plans despite the reputation of many MA insurers who deny legitimate medical claims.

Many people, supporters and opponents of such expansion, wonder about the added cost. Here are some recent estimates:[3]

Hearing Services: hearing aids and related services could cost $1,000 to $2,000 per person annually.

Vision Services: routine eye exams and eyeglasses could cost $2,000 to $3,000 per person annually.

Dental Services: dental cleanings, fillings, and dentures could cost $1,500 to $2,500 annually.

When calculated for 65 million beneficiaries x 10 years, a total cost for all three programs would amount to $292.5 billion to $487.5 billion over 10 years – less than half the Trump-proposed tax cut for the wealthiest portion of our population.

People who lack dental or vision coverage, report that they did not receive or use these services because costs were unaffordable (62% dental, 53% vision).[4]

Overcoming Opposition to Expanding Medicare

In addition to the possibly illegal and certainly immoral destruction of federal government support for current healthcare programs by the Trump administration, opponents to expanding Medicare/Medicaid fall into four major groups:

Many officials and their supporters object to higher costs and increased government spending. Some states, for example, have yet to accept Medicaid to provide health insurance for their least well-off citizens. This group favors market-based, private health insurance solutions to prevent what they claim are government inefficiencies. People who cannot afford private health insurance premiums must simply remain uninsured.

Private insurance companies often fear that expansion of Medicare would reduce the number of persons who purchase MA plans. Given the poor reputation of many private insurers for denying claims, this might be a legitimate concern for private insurers.

Some clinical providers point to possible reductions in reimbursement rates and increased administrative expenses for them. This objection could be addressed in implementing legislation.

Many people harbor ideological commitment to limited government and market-based solutions. Expansion of Medicare/Medicaid, for them, is a step toward “socialism.”

And yet, opponents fail to take certain factors of the current situation into account.

For instance, it is not at all clear that private insurance carriers are more efficient than government-operated services. Administrative costs for Medicare run about 1.4% to 6% of total expenditures. Administrative costs for private health insurers cover marketing, billing, customer service, claims review, and profits; they run about 12% to 18% of total expenditures.[6] This is why private insurers deny such a large number of claims to maintain and increase their profit margin.

Although Medicare expansion might eat into the number of persons who would otherwise opt for MA plans, private insurers could serve as administrators of the Medicare program while simply accepting a lower profit level. Private companies do this routinely in Europe.

Ideological proponents of limited government often fail to see that government might be the best solution for problems that are beyond the resources of individuals or even large organizations. Military defense, environmental protection, and healthcare are surely among those areas that require governmental action.

Many older folks are struggling with limited access to medical services, not enough insurance coverage for treatments they need, and a lack of specialized care. This isn't just about their health; it's about their dignity and quality of life. It's high time we acknowledge these issues and start working on real solutions to ensure that seniors get the care and respect they deserve.

Main Takeaways

Our healthcare industry is not meeting the needs of senior citizens.

We should expand Medicare to cover long-term care, including in-home care services.

We should expand Medicare to cover basic dental, vision, and hearing services.

Both of these expansions are likely to save money regarding overall expenses for healthcare nationally.

Such expansion should be carried out as soon as possible and despite the intentions and actions of the Trump administration to gut or eliminate Medicare and Medicaid.

What am I missing? Please add your own thoughts in the comments.

These posts on Elder Vibes require a substantial amount of research. I read government reports, scholarly papers, and other material so you don’t have to.

I have therefore activated the paid subscription option.

Although all posts remain free, please consider upgrading to a paid subscription if you can. An annual subscription works out to only $4.17 per month and will entitle you to additional features and content (podcasts, online interviews, live chats) as the newsletter develops.

NOTES

[1] What is calculated as income and “countable assets” varies by state and can be complicated. For more information about this and how an individual might become eligible for “medically needy” care situations, see the American Council on Aging, Medicaid Eligibility: 2025 Income, Asset & Care Requirements for Nursing Homes & Long-Term Care, https://www.medicaidplanningassistance.org/medicaid-eligibility/.

[2] Gopi Shah Gopi and Courtney Harold Van Houtven, “Expanding in-home care coverage is a needed evolution of Medicare,” Brookings, 28 October 2024, https://www.brookings.edu/articles/expanding-in-home-care-coverage-is-a-needed-evolution-of-medicare/.

[3] Meredith Freed, Juliette Cubanski, Nolan Sroczynski, Nancy Ochieng, and Tricia Neuman, “Dental, Hearing, and Vision Costs and Coverage Among Medicare Beneficiaries in Traditional Medicare and Medicare Advantage,” Kaiser Family Foundation, 21 September 2021, https://www.kff.org/health-costs/issue-brief/dental-hearing-and-vision-costs-and-coverage-among-medicare-beneficiaries-in-traditional-medicare-and-medicare-advantage/.

[4] Julie Lee, “Cost Considerations Limit Access to Dental, Vision, and Hearing Services for Under-65 Medicare Beneficiaries,” The Commonwealth Fund, 12 February 2025, https://www.commonwealthfund.org/blog/2025/cost-considerations-limit-access-dental-vision-and-hearing-services-under-65-medicare.

[5] Freed, et al., “Dental, Hearing, and Vision Costs…”

[6] Manuela Tobias, “Comparing administrative costs for private insurance and Medicare,” Politifact, 20 September 2017, https://www.politifact.com/factchecks/2017/sep/20/bernie-sanders/comparing-administrative-costs-private-insurance-a/.