Should I Switch from Medicare Advantage to Original Medicare?

Years ago, I fell into the Medicare Advantage trap. I’m finding that correcting my mistake is an unwelcome hassle. Don’t do what I did.

Breaking news! The U.S. healthcare system is a mess.

Sorry, you already know that. But when you really dig down into the details (where the devil thrives), you find out that it’s much worse than you’ve been led to believe.

As are you, I’m aware of some of the true horror stories about people who have been denied care by major insurers who seek greater profits. Fortunately, I’m not one of them…at least not yet. But they can happen to anyone who relies on private health insurance carriers through their employer, the Affordable Care Act (where CVS/Aetna is pulling out), or Medicare Advantage.

Years ago, without any research or reflection, I fell into the Medicare Advantage trap when my former employer provided healthcare coverage as a retirement benefit. That worked fine for a while until they withdrew the benefit last year, throwing me into the insurance marketplace on my own.

I’m now investigating whether I can or should return to Original Medicare. Many people face such a question. If you or someone you know is trying to hack their way through the jungle, perhaps my story will help.

Benefits of Original Medicare

Original Medicare (hereafter, simply Medicare) insures about 64 million elderly people. Here are the basic features.

Enrollment is virtually automatic for those who reach age 65. Persons younger than 65 who qualify for SSDI benefits also qualify for Medicare. Anyone 65 or older must have paid Medicare taxes for at least 10 years to receive Medicare Part A (hospital insurance) for free.

Medicare Part B covers outpatient care, doctor visits, preventive services, and medical equipment for a monthly premium that is automatically deducted from SSA benefits.

Medicare Part C refers to Medicare Advantage plans – which have been previously discussed.

Medicare Part D covers the cost of prescription drugs; coverage must be purchased through supplementary insurance.

Medicare coverage is the same nationwide. You won’t need to worry about coverage if you travel to other states or regions.

If Medicare covers a specific procedure, treatment plan, or medication, no pre-authorization or denial of care will be imposed.

While clinical providers (physicians, physician assistants, hospitals, clinics, other providers) must participate by accepting Medicare’s payment rates, there is no in-network/out-of-network hassle to worry about. With Medicare’s basic plans, you’re covered, no questions asked.

You won’t need to worry about sudden changes in Part A and B coverage or in the prescription drug formulary for Part D. Medicare does not impose billing surprises.

Disadvantages to Medicare

The following disadvantages to Medicare are often exploited by MA plans to attract subscribers.

Medicare Part A and B covers about 80% of most costs, leaving you to obtain coverage or pay out-of-pocket for the remaining 20%. With today’s prices, that 20% can easily bankrupt people of low or modest means.

The answer is to purchase Supplementary Medicare Insurance (a.k.a., Medigap). Since I have no serious chronic illness or conditions, I was quoted an average of $270 per month for Medigap coverage – a serious hit to my budget.

Important note for new Medicare subscribers: You have an “open enrollment” period of about 6 months after you turn 65 to enroll for Medigap coverage. During that time, coverage is almost always guaranteed, no questions asked. If you join later, however, the insurance carrier might require a medical examination and could deny coverage or charge a higher premium. Since I had MA coverage for several years, I would be subject to such medical underwriting analysis.

Medicare offers no cap on the amount of money that you might be compelled to pay for services, whereas many MA plans do cap your out-of-pocket expenses.

Medicare does not cover vision, hearing, or dental expenses, except for limited coverage of serious medical conditions that require surgery.

Unless you purchase private prescription insurance under Part D, Medicare does not cover prescription drugs. Since I take the lowest dose of only two prescription drugs, I was quoted a monthly premium of less than $10. However, the cost of prescription drug coverage can be as much as $100 per month.

Analysis and Conclusion

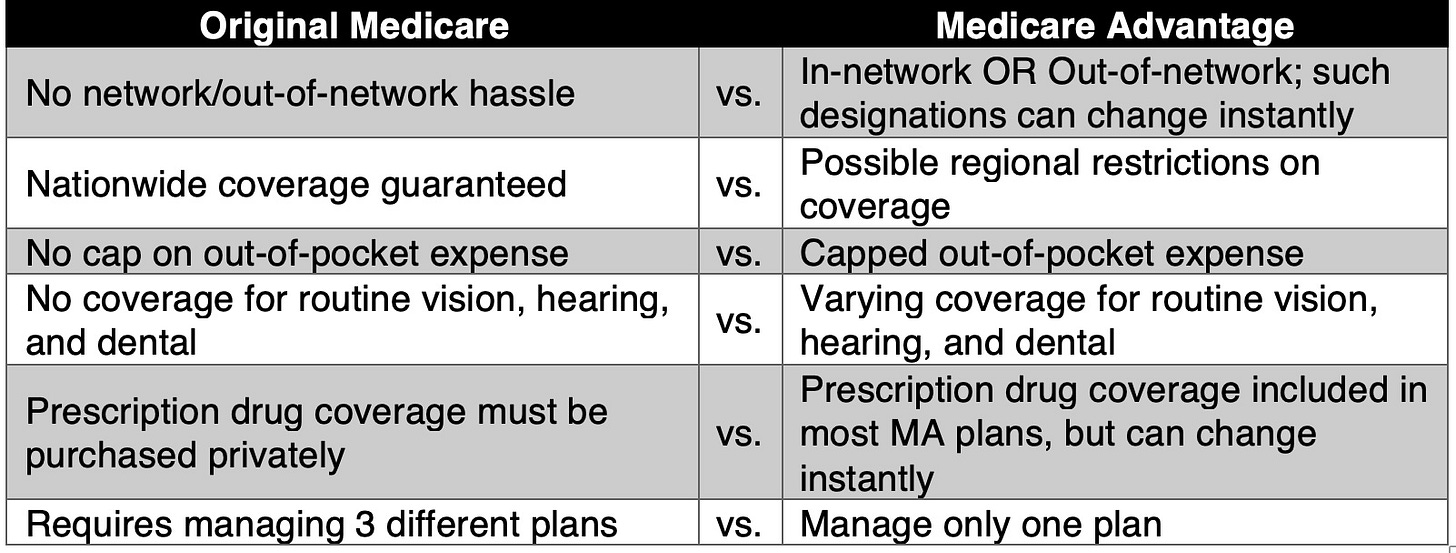

Since the kind of coverages available through original Medicare (with supplementary Medigap and prescription during plans) and Medicare Advantage do not match up, I’m left with a list of undesirable tradeoffs. While actual numbers can vary widely according to individual circumstances, these tradeoffs are mostly the same for everyone.

I’m still undecided. The extra premiums required (but, as yet, undetermined) for original Medicare would exceed my out-of-pocket expenses routine for vision, hearing, and dental services minus the limited MA coverage now provided.

Nevertheless, uncertainty about finding in-network providers who are available causes me to avoid significant, possibly invasive treatment. As I get older, I can expect more serious health problems to arise.

All of this leads me to conclude that neither option provides all that I actually need now or in the future.

From a policy perspective and after considering the extra administrative expense of privatized MA plans, original Medicare is obviously preferable. Widely reported tales of the horrors of MAs’ denying much needed care to individuals who need expensive treatment justify eliminating privatized healthcare as soon as possible.

But to provide what people truly need, Medicare should be expanded beyond its current, clunky form. Routine visual, hearing, and dental care should be included. Prescription drug coverage should be routinely covered. Medicare should also be permitted to negotiate prescription drug prices with Big Pharma. And finally, the money saved by eliminating the administrative expenses soaked up by MA plans should be devoted to expanding and improving Medicare.

Of course, the current regime is interested in none of that. The Republican autocracy is interested only in eliminating publicly funded programs in favor of increasing privatization that would benefit the morbidly wealthy. In such a scheme, the true beneficiaries of the American healthcare system will be the wealthy stockholders. The sick and the disadvantaged, including elderly people, can go pound sand.

I conduct research for these posts so you don’t have to.

If you have the means to do so, please sign up for a paid subscription. An annual subscription works out to only $4.17 per month and will entitle you to additional features and content (podcasts, online interviews, live chats) as the newsletter develops.

I’m on original Medicare, with a supplemental private policy (Medigap). The monthly premiums are affordable if you are able to manage a higher deductible-which is still quite modest compared to what we had to cover prior to turning 65.

We don’t have vision or dental coverage—we just pay out of pocket. Our dentist offers a program that for $120 per year we get a preventative exam and a hefty discount on services..the numbers work out to be roughly equivalent to having dental insurance, which is pretty useless in that the annual caps are so low. Vision coverage hasn’t really been an issue—maybe we aren’t average but at this age your prescription doesn’t change that often. I get new glasses every couple of years not because my vision changes, but because my lenses are usually scratched up and it drives me crazy to not have absolutely pristine lenses.

We live in a rural area with limited providers and never even considered MA because of the risk of not being able to find an in-network provider. My mother, who was in the Portland, OR service area for Kaiser, had a Kaiser MA plan that was excellent. They covered her extensive and expensive needs, no questions asked. They covered hearing aids and vision. She had a heart attack followed by a long hospitalization until she could be stable for surgery, and it cost her nothing other than a bill for the ambulance ride to the hospital. I saw the itemized statement from Kaiser and the cost was about $375K.

I don’t know if there are other providers like Kaiser nationally, but I would consider MA but only from a wraparound system like they offer. Traditional Medicare requires more administration from me (buying and managing separate policies), and an ability to cover routine expenses and about $2500-$3000 in out of pocket costs, but if you can manage that the trade off is not being denied care when something serious happens.

You can go to any provider that you want with original medicare. No benefit of MA comes close to that. I am 73 and not sick, on medicare. [1] But I had a fairly serious fractured proximal humerus two years ago and I was able to get the best surgeon. I ended up staying in the hospital for a day and they had a woman in a suit hand me a letter saying that my doctor had decided to hold me for "observation" and that was the best for medicare. [paraphrase - I was on drugs]. The hospital sent an itemized bill, charging the 20%. CMS said no, this is one hospital admission and it is all covered under the PART A deductible. It was less, I can't remember by how much. [massachusetts] [2] I was in a van accident when I was still a tour guide in Florida. They have a weird no fault law that charges your personal insurance as the secondary insurer after the auto insurance. Naples Community Hospital kept sending a bill for $2500. I called and told them to send it to medicare. It was a big deal to get them to bill medicare but they finally did. CMS said NO, you have already been paid enough. CMS reviews the bill and adjusts it regularly. You get statements that say - this is what they billed - this is what we paid - this is the most you can be billed [if you have no other insurance]. There are some rules for MA but not enough. I lobby my fellow seniors to get regular medicare because I think MA is a path to take our medicare away. I think medicare will be improved, especially if we all have it. MA is for profit.